Hearing from a freelancer or contractor that they’re welcoming a baby into their lives is a classic case of a good news/bad news moment. You might be over the moon for them personally—and then left wondering how you’re going to manage without them during their leave.

Technically, you’re not obligated to offer paid parental leave to any independent contractor under the Family and Medical Leave Act. But the support you show them now can make a big difference whether or not they choose to continue working with you after their leave.

Freelancers love the freedom and flexibility of self-employment. But when it’s time to prepare for the arrival of a new baby, the lack of structure (and an HR department) can be daunting.

Offer benefits that build a long-term relationship

The average cost of giving birth in the U.S. is over $18,000, and that number goes up for C-sections or dealing with any complications. That doesn’t include the dozens of doctor’s or midwife appointments and tests conducted throughout a pregnancy—by the third trimester, many pregnant women are seen weekly—which can add up to a real financial burden for your contractors.

As part of being on the Wingspan platform, contractors get access to pre-vetted licensed brokers to help purchase health, vision, dental and life insurance benefits beyond what is available as individuals. And for a fee, contractors can purchase big company benefits, called Premium Perks, including 24/7 Teladoc telemedicine.

Even if you’re not interested in offering paid leave, providing access to routine and necessary medical care for your contractor or their partner can be a big relief.

Help your contractor find state-by-state benefits

While some states have parental leave programs that allow freelancers and contractors to apply, others provide little to no support for independent workers. Their options will vary depending on where you live and your work’s exact nature, but taking leave is possible with careful planning. Your contractor may be feeling overwhelmed at all of this—depending on your business, you may already have this information handy with your HR department. Either way, offering up an HR representative to help talk them through their leave options, even if they can’t get leave through your business, is another way to build a long-term relationship that will encourage them to come back.

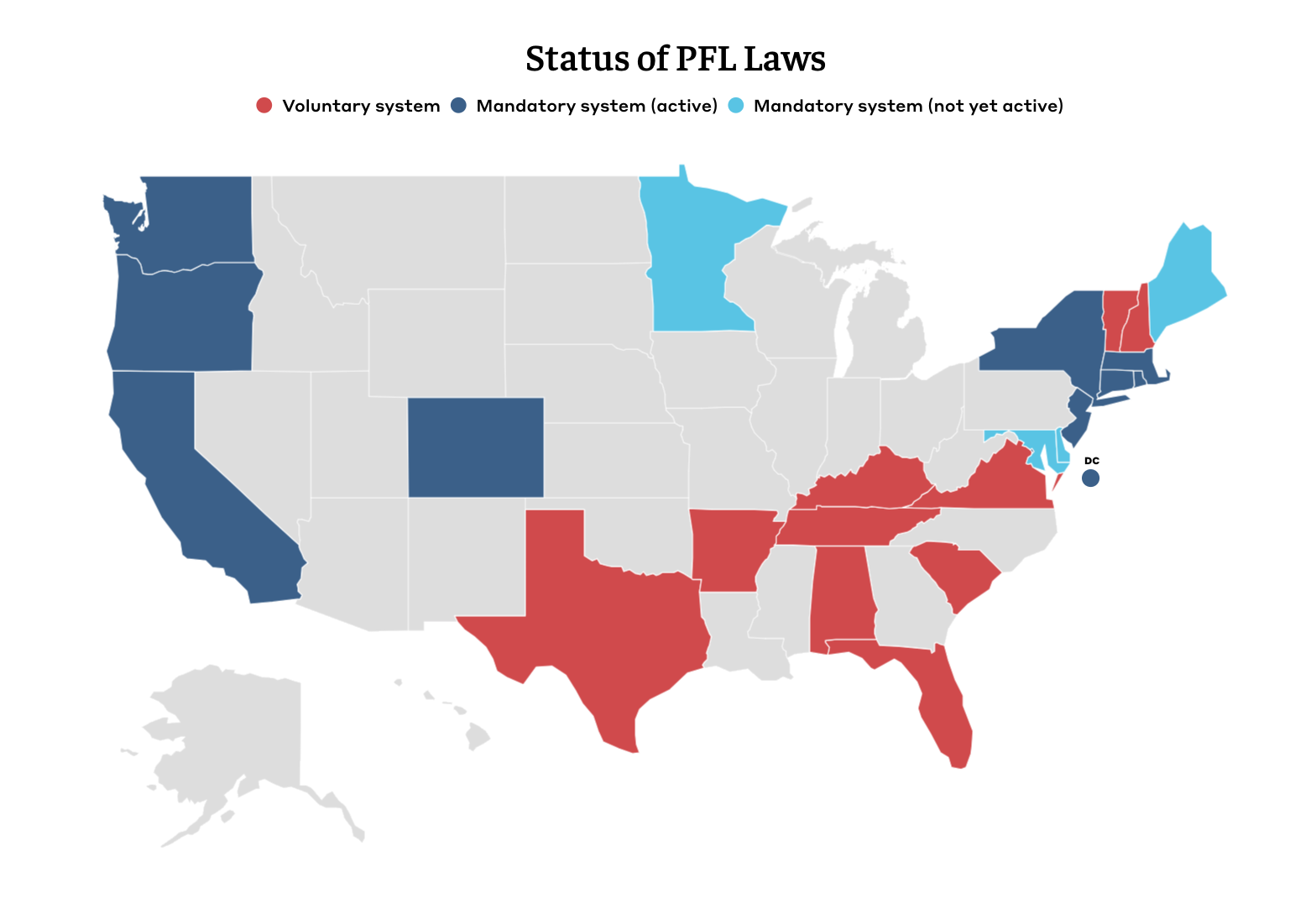

Currently, thirteen states and the District of Columbia offer some kind of mandatory paid family leave program, and ten states offer a voluntary paid family leave program through insurance programs. The specific benefits and who qualifies for the program vary from state to state. Washington’s program provides self-employed people with up to $1,000 a week for 12 weeks, but you must opt into it. Meanwhile, in Massachusetts, self-employed folks and some 1099-MISC workers qualify for the state’s leave program, but independent contractors will not.

Source: https://bipartisanpolicy.org/explainer/state-paid-family-leave-laws-across-the-u-s/

The simplest way for your contractors to find out if they’re eligible is to get in touch with their state’s family leave or labor offices. California, New Jersey, and New York residents are provided with numbers they can call. People living in Massachusetts, Oregon, Washington D.C., and Washington state can send their questions via email or through an online message form. And Rhode Islanders can consult the state program’s FAQ page for further info.

If they live in a state that doesn’t offer a paid family leave program for freelancers, the next best option is short-term disability insurance. Most policies cover about six weeks after giving birth. Still, if you encounter complications during delivery or give birth via C-section, you might qualify for more extended periods of coverage. This is where offering benefits to your contractors make a big difference, as many states only offer paid leave programs connected to their insurance.

Be transparent about parental leave coverage in their absence

Unlike a full-time employee, freelancers and independent contractors have no applicable laws to protect their engagement with you beyond any specific terms negotiated in your contracts. They may be anxious about whether or not taking parental leave is even possible.

If this is a contractor you want to keep working with, be transparent with them about finding coverage while they’re on leave, and how that will or won’t affect your working relationship with them moving forward. Depending on the nature of their work with you, offering up additional projects or working ahead before their leave can help cushion the financial blow of taking time off. And set a communication plan ahead of time of how you’d like to restart your working relationship, including timeline, when they do return.

Build better contractor relationships with Wingspan

You don’t need to keep a job posting constantly open for a revolving door of independent contractors. When you find a contractor you love working with, start thinking of them as an extension of their team. Parental leave is such an exciting milestone for them—so help them celebrate and prepare.

With Wingspan, you can offer benefits and solve their headaches to give you more loyalty and billable hours in the future, no matter where they are in their personal life. See how Wingspan streamlines contractor management so you can focus on relationships >